BUSINESS NEWS - 2025 was off to a great start. We were coming off two strong years of returns.

Inflation was coming down and no longer an issue, the US labour market was at close to full employment, and corporate earnings were beating expectations.

There was even growing optimism that rate cuts would start sooner rather than later. Even the GNU, locally, looked like it was working and the JSE was at all tie highs with the rand at R18.2 to the USD.

And then came 2 April. The Trump administration’s “Liberation Day” tariffs hit global markets hard — every country in the world was hit with aggressive ‘reciprocal’ tariffs.

Of course, the formula for the tariffs didn’t make sense. Just like much of the reasoning behind the tariffs.

The chart below from Ritholtz Wealth is actually amazing — it shows the evolution of all the so-called ‘reasons’ for these tariffs.

The point I take from the chart above is that none of these so-called reasons are actually the real reason for the tariffs. They feel more like post hoc rationalisations — excuses layered on top of a decision that was already made, without ever revealing the true motive.

Markets, which are always trying to price in future expectations, simply can’t function properly with this kind of uncertainty.

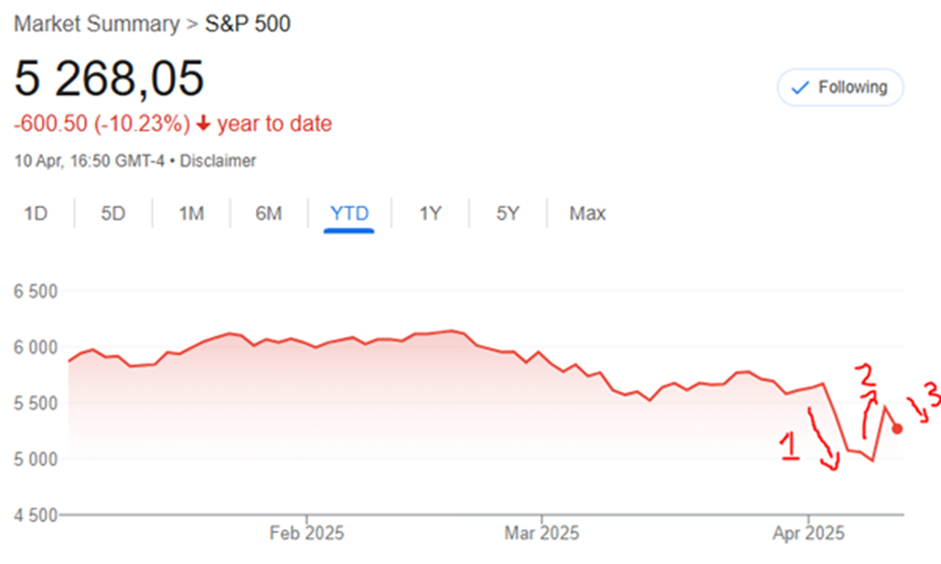

Global markets are reeling. Just look at the S&P 500. The negativity at the start of the year was sparked by Trump’s initial tariff threats on Mexico and Canada — which were on, then off, then higher, then lower.

Who knows anymore?

Then came 2 April with the ‘Liberation’ sweeping tariffs on every country in the world. See where I marked 1? That was a 10% decline in markets over a 2 day period.

And then Trump blinked.

According to the Wall Street Journal, Trump hadn’t quite expected the markets — especially the bond market — to react the way they did.

Remember my piece The market doesn’t care what you think? Well, it turns out the market doesn’t care what Trump thinks either. He seems to believe markets like him, based on the positive reactions to his previous calls for lower taxes, deregulation, and reduced government spending.

But the reality is, markets are indifferent. They don’t care about ego or intention — they just respond to outcomes. And this time, they sent a very clear message.

On Wednesday morning, Jamie Dimon — CEO of JPMorgan Chase — went on Fox Business. He knew Trump would be watching. In the interview, Dimon openly warned that the tariffs would very likely lead to a U.S. recession.

And then, within 90 minutes of the tariffs going live, Trump pulled the plug and announced a 90-day pause. The reaction? U.S. markets bounced back by 9% in a single day — see point 2 in the chart below.

I wonder who sold out at the bottom — after that 10% drop over two days? They missed the bounce. Fear can do strange things.

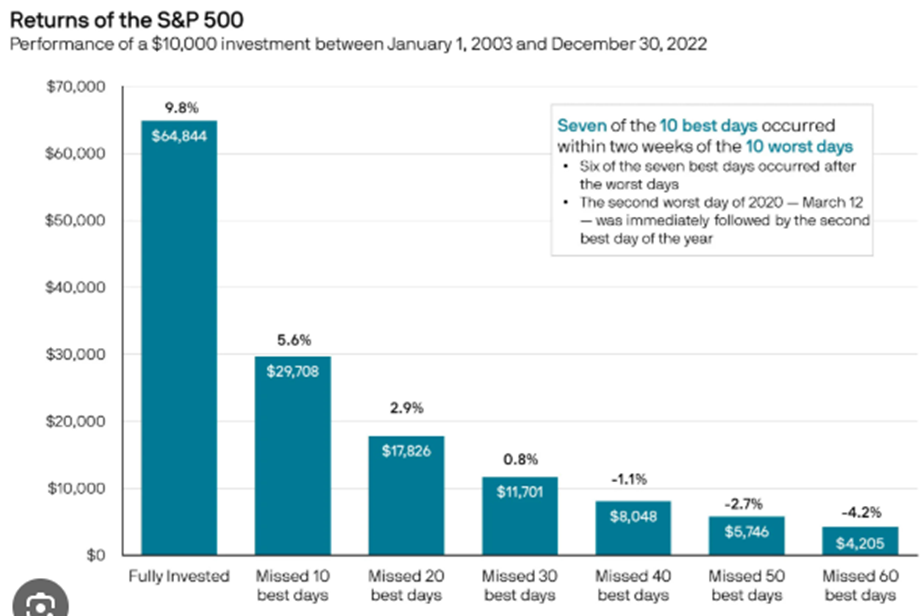

It reminds me of those charts that show what happens when investors miss the market’s best up days — which almost always follow the worst down days. Those who missed out on that 9% rebound are already in a dramatically worse position than they would have been had they just held on.

The chart below shows that missing just the 10 best days can reduce your annualised return by up to 4.2%, cutting your capital in half over time.

This is also why the average retail investor performs so poorly. They miss they best days of the markets, because they sell after the worst.

A quick search will show you — the research is everywhere. Most retail investors are driven by emotion. They tend to buy when they feel comfortable (which is usually when markets are high) and sell when they feel afraid (when markets are low).

The internet is full of charts that show this behaviour. The one below was literally the first result that came up.

So, what now?

Trump has now increased tariffs on China to over 100%. Point 3 in the S&P chart below shows the result — U.S. markets dropped more than 4% yesterday.

This is exactly why we build portfolios the way we do. This is why we have financial plans. For unexpected black swan events like this. This is why your mandate — your balance sheet and your life circumstances — is so critical. It’s the starting point for everything.

For example, if you’re drawing income, we’ve likely structured things so you’re not relying on equities alone. You probably have a cash buffer — enough to cover several years of income — so you don’t need to sell growth assets when markets are down. We’ve planned for taxes.

We’ve planned for flexibility. Most importantly, we’ve planned for the unexpected.

This is why you have a plan: to protect you from making poor decisions that can be devastating to your portfolio — and by extension, your life.

So, here’s the advice: don’t panic. Don’t abandon the plan. This is exactly what it was designed to handle. If you're clear on your mandate, and your asset allocation matches that mandate, you will be fine.

Stay calm. Stay the course. This too shall pass.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’