Investor Stewardship 2024

The hot seat

Who occupies the hottest seat on a board of directors? It depends on the circumstances

While a CEO might face the toughest questions when an activist investor shows up, and the chief financial officer the biggest grilling from analysts, modern stewardship trends dictate that the chair of the nominating and governance committee is often the one that attracts the most shareholder scrutiny at annual meeting time.

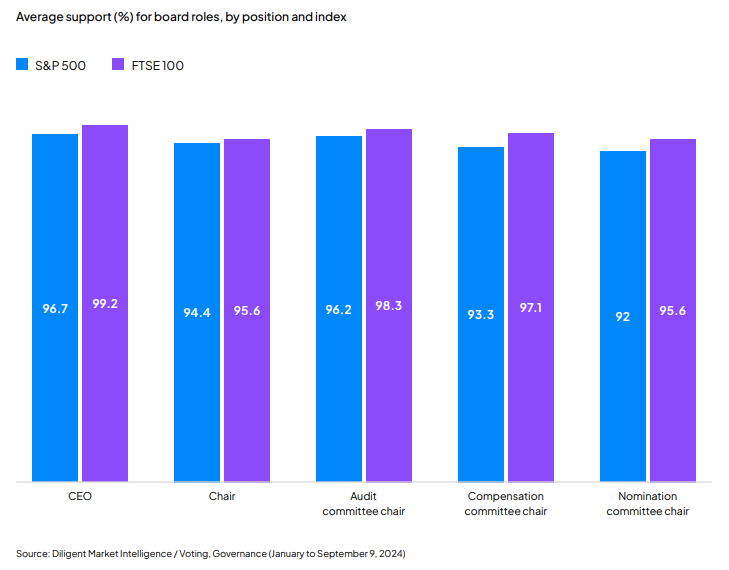

“Over the last decade, institutional investor voting has evolved to targeted votes against members of committees that they view as responsible for inaction or action on specific events,” said Stephen Brown, senior advisor at the KPMG Board Leadership Center. “The nominating and governance committee is just the newest entrant here.” Data from Diligent Market Intelligence (DMI) show that nomination committee chairs received the lowest average support of all senior board positions in the period from January to September 9, at 92% in the S&P 500 and 95.6% in the FTSE 100.

CEOs received the highest support, at 96.7% in America’s premier index and over 99% among the biggest London-listed companies. “In years past, there was more of a preference to vote against a line-item proposal than a director,” such as auditor ratification or “say on pay,” Karla Bos, associate partner at Aon, told DMI. “But in recent years we’ve seen more investors move away from trying to target specific proposals to focusing on board accountability, which by definition elevates focus on boards or certain committees or directors.”

Board accountability

With many areas falling under the purview of the nominating and governance committee, Bos argues that the role of chair carries increasing responsibility. “Board evaluation, composition, refreshment, diversity. It’s much more than ‘just’ renominating or nominating directors.”

“I would figure if you were mad about something, you would vote against the CEO,” said Doug Chia, president of Soundboard Governance. “If you’re looking at it from a governance perspective, a board perspective, you would focus on that [nominating] committee.”

BlackRock’s U.S. stewardship guidelines suggest the investor will vote against the nominating and governance committee chair, or the most senior member of that committee, in at least six scenarios. Those include inadequate explanations for lacking board diversity, adopting a poison pill or entrenchment tactics and a lack of board responsiveness to shareholders.

Elsewhere on the board

In contrast, the investor offers more succinct reasons for voting against compensation committee members: when pay is excessive or not aligned with shareholders, or when a “say on pay” vote is not scheduled as frequently as shareholders request.

Mind you, despite improving “say on pay” approval rates, compensation committee chairs average the second-lowest votes among committee chairs in the S&P 500, at 93.3%. In the U.K., compensation committee chairs do better, with an average of 97.1% of votes in favor.

DMI data also show one nomination committee chair received less than 50% support – at AO Smith – with investors mostly citing the company’s dual-class share structure and lack of a sunset clause. However, as if to emphasize the range of concerns placed on the nomination committee, other investors also mentioned a lack of responsiveness to previous shareholder votes, failure to disclose EEO-1 data, lack of board diversity, and the combination of the chair and CEO roles, according to DMI data collected directly from investors.

“Given engagement constraints, issuers would benefit if more investors disclosed voting rationales,” Bos says of the multitude of potential reasons for “against” votes.

“Companies are going to need to have more and more access to that data. If they’re not using a trusted advisor for support, it’s a tremendous lift to go through hundreds of stewardship reports.”

The only compensation committee chair to receive less than 50% support during the 2024 proxy season was targeted in a proxy contest. Although, in 2022, a majority of investors voted against the chair of Netflix’s compensation committee due to ongoing concerns about the company’s pay practices and to “escalate” the matter after several years of below-average support for the company’s “say on pay” resolution.

No member of an audit committee failed to receive majority support in 2024. For the two that received around 70% of votes for, investor voting rationales cited nominating committee concerns like board diversity, rather than their membership of audit committees.

While many directors will feel a professional desire to avoid getting the lowest share of votes, there is also a recognition that sometimes boards have to “absorb some hits over time” and make unpopular decisions for the good of the business, says Chia. “I don’t think any chair or committee is immune to shareholder angst,” says Brown. “That said, I think when shareholders think about the role of audit committee they do think about the committee as a whole, versus singling out the chair.”

“Directors should not take those votes personally,” he concludes. “That’s just the risk you run when you agree to take on those positions.”

CEO pay rebounds as market bounces back

With U.S. markets rebounding after a down year in 2022, median executive compensation also bounced back with pay plans securing greater support from investors

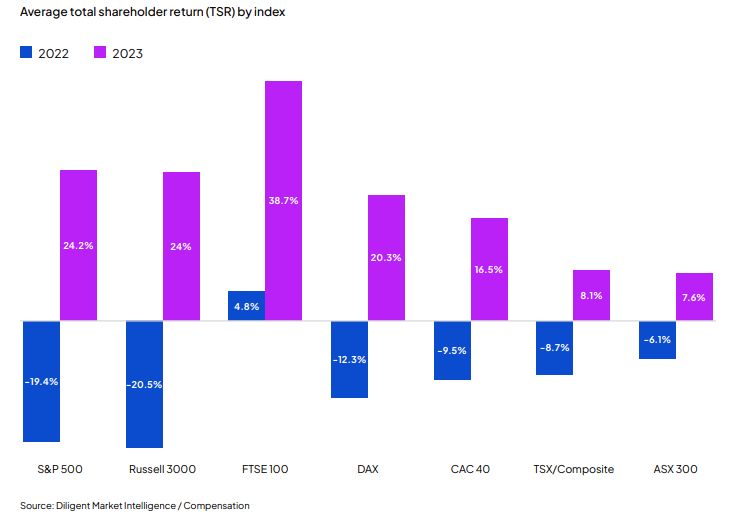

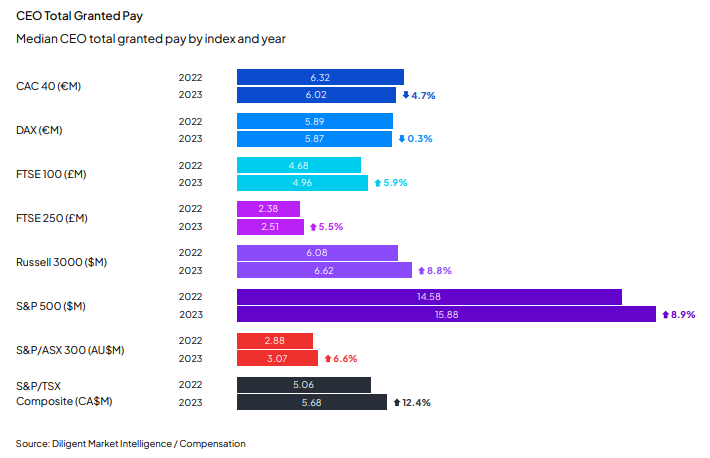

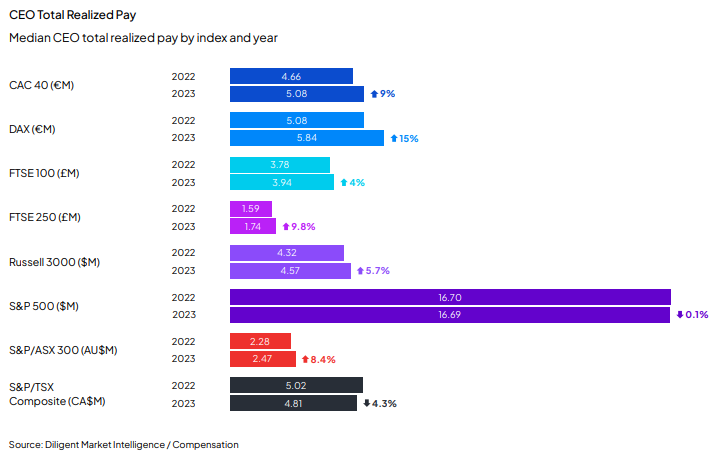

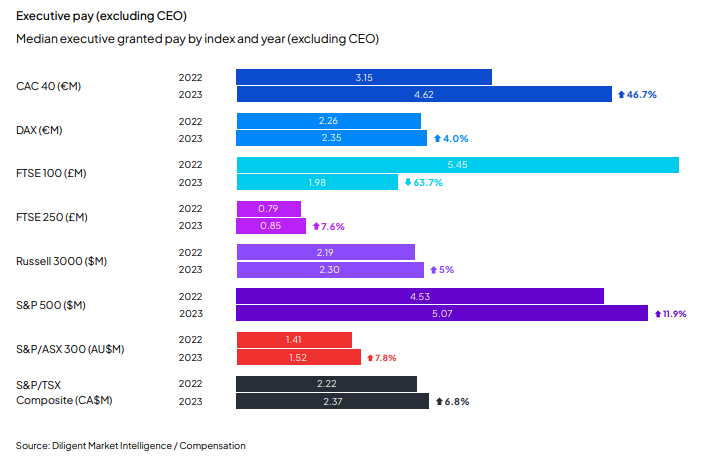

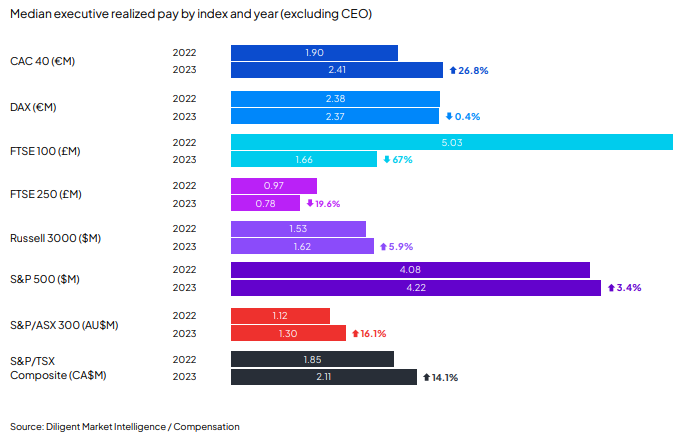

After delivering negative returns to shareholders in 2022, the S&P 500 and Russell 3000 indexes jumped back to positive in 2023 and with the rebound in performance, median granted and realized CEO pay recorded substantial gains.

According to Diligent Market Intelligence (DMI) data, the median granted pay package for an S&P 500 CEO in 2023 was $15.9 million, an 8.9% increase on the year prior, while the median granted pay for Russell 3000 CEOs was $6.6 million, up 8.8% on 2022.

“Stock markets in the U.S. increased to substantial gains in 2023,” Rebeca Coriat, head of stewardship at Lombard Odier Investment Managers, told DMI. “In general terms, compensation in the U.S. keeps increasing, despite some relative low dips during some years.”

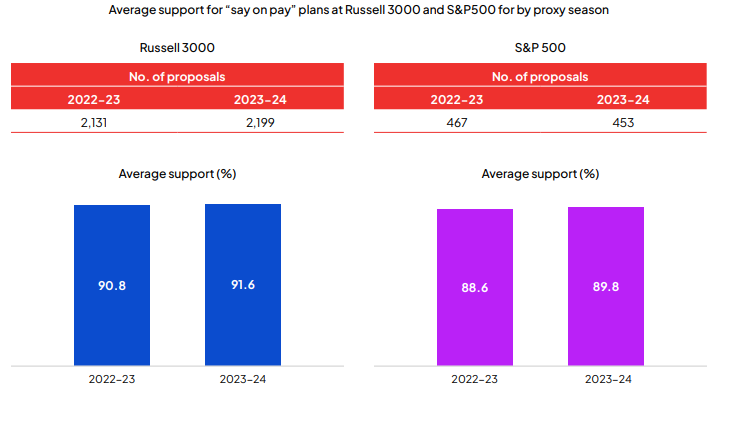

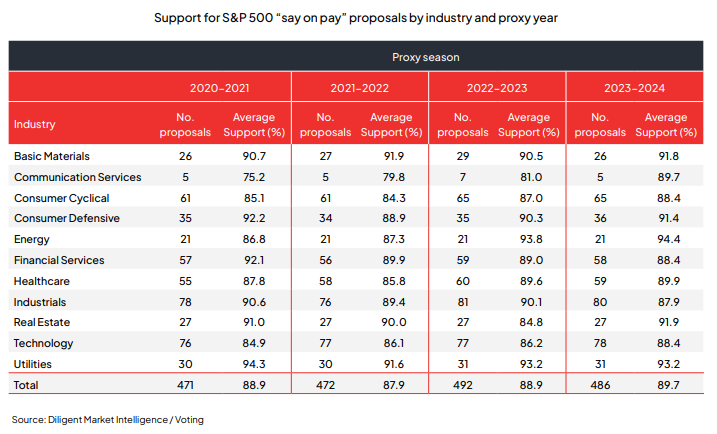

Meanwhile, improved market conditions and increased levels of issuer communication have also translated into more positive investor sentiment, with shareholder support for “say on pay” proposals this proxy season at the highest level since 2020.

Speaking with DMI, Matthew Roberts, associate director, stewardship at Fidelity International noted that over the years since “say on pay” was introduced, “many companies have developed a better understanding of what shareholders expect in terms of compensation design and disclosure, as well as what tends to garner opposition.”

Pay for performance

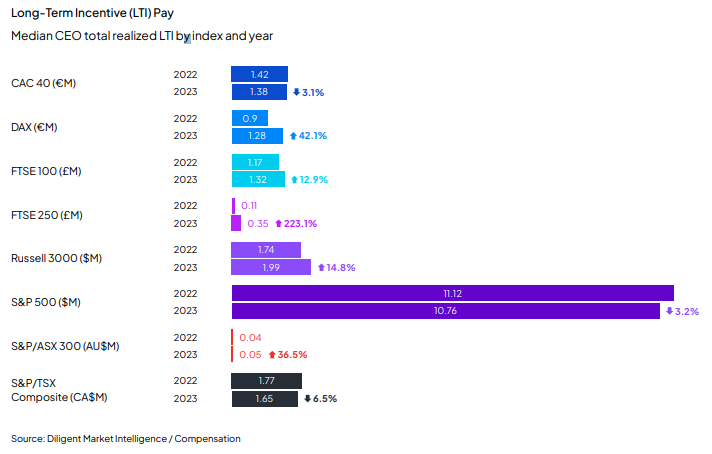

Against the backdrop of a down market in 2022, median CEO realized pay was stripped back by 0.4% in the S&P 500 and 3.5% for the Russell 3000. However, as market performance ticked upwards in 2023 with the S&P 500 and Russell 3000 indexes delivering an average total shareholder return of approximately 24%, median CEO take-home pay in the S&P 500 stayed largely flat, while the median pay of Russell 3000 CEOs went up by 5.7%.

Coriat noted that the rise has been driven by two key factors – performance-related plans and time-vesting plans.

“For the former, as targets were met (potentially at target and maximum levels), higher payouts have taken place. Regarding the latter, in cases, restricted stock was awarded one, two or three years ago and remuneration committees may not have modelled the extreme range of share price increases that could occur, explaining some of the increases we have seen,” she noted. “In such cases, it could have been expected that remuneration committees exercised some degree of downward discretion to nuance the unexpected gains.”

Coriat also argued that U.S. pay structures continue to influence other markets, pointing to a move by U.K.-listed companies towards hybrid remuneration packages that include performance-related and time-vesting plans.

Investors upbeat

Better alignment and increased investor engagement on executive compensation lifted support for advisory pay resolutions to 91.5% at S&P 500 and Russell 3000 companies, a second successive increase after consistent declines from 2018.

The number of proposals that failed to win majority support has also decreased, with just 25 “say on pay” resolutions failing this season, compared to 42 in the last.

Vanguard, which supported 98 % of management “say on pay” proposals in the U.S. during the 2024 proxy season – up from 96% last year, noted a decline in the use of one-time retention awards and an increase in the use of absolute stock price hurdles within remuneration packages.

“When a program is heavily based on absolute metrics, clear and comprehensive disclosure of the board’s targetsetting process helps shareholders assess the rigor of these metrics and their alignment with long-term company performance relative to their peers,” Vanguard stated.

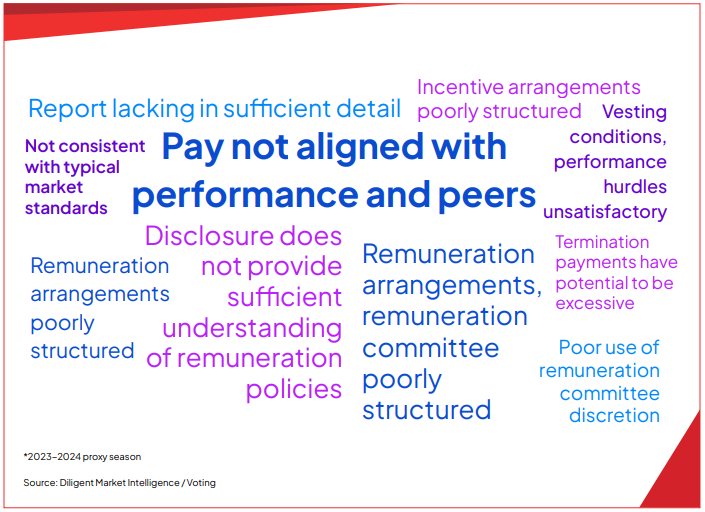

BlackRock, which in its latest voting spotlight revealed that it had supported approximately 92% of “say on pay” proposals at U.S. companies during the most recent proxy season – up from 91% the season prior – noted that its increased backing reflected “better program disclosure and increased alignment with companies’ long-term financial outcomes.”

“I think boards and companies are really embracing the engagement process,” Alliance Advisors Senior Vice President Brian Valerio told DMI.

Valerio noted that while there is increased engagement between boards, investors and proxy advisors following annual meetings, issuers are also improving their communication in the run-up to meetings.

“Companies are utilizing supplemental proxy materials when there are issues that they might be hearing during the solicitation, whether it be a proxy advisor firm advising against the proposal, or if there is a theme identified during engagement with investors,” Valerio added. “Supplemental materials can provide context that can turn a vote from a ‘no’ to a ‘yes’.”

Most referenced pain points in BlackRock rationale on votes against “say on pay” at Russell 3000

New window of transparency as hedge funds disclose pay voting

Changes to N-PX disclosure rules by the Securities and Exchange Commission (SEC) have opened up a new window of transparency into how hedge funds and others vote on executive compensation

With registered funds and institutional investment managers holding substantial proxy voting power that they exercise on behalf of millions of investors, the wave of filings submitted by the end of August deadline each year has been a pivotal point in the Diligent Market Intelligence (DMI) calendar year, and a key part of our expanding data sets.

By the end of September and with the first filings subject to the amendments, the DMI research team had added 38,399,672 votes with 10,209 filings processed, compared to 2,658 such filings at the same time last year.

This import brings us key insights on 3,935 investors, 15,559 funds and almost 25,000 issuers.

“Investors that provide minimal policy disclosure and until now haven’t disclosed any votes, such as hedge funds and various other firms that don’t manage mutual fund shares – there is a lot we can learn from their disclosures and help convey that to companies. This includes looking at any significant alignment with proxy advisor recommendations,” Karla Bos, associate partner at Aon, told DMI.

The ‘for’ and ‘against’ buckets

The new regime requires managers that exercise investment discretion over securities with an aggregate value of at least $100 million to report their pay votes – a rulemaking dictated by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act.

The expansion is expected to provide both risks and opportunities for the new filers with greater scrutiny of their voting decisions. While some may embrace the opportunity to demonstrate their governance standards and their focus on responsible compensation structures, the disclosure may also expose some who are seen to have backed management on pay where packages are considered egregious.

“We now can look behind the curtain and have the opportunity to lift the hood and really analyze their voting directions. If they are consistently supporting lavish pay packages that are not aligned with company performance, putting that out there publicly likely won’t serve them well,” Marcus Campbell, managing director at Sodali & Co., told DMI. “There’s an opportunity for the funds to differentiate themselves by voting in favor of more responsible compensation structures, which may resonate with long-term investors.”

As well as expanded disclosure on pay, the changes will also shine a light on the number of shares voted, or instructed to be cast, as well as the number of shares loaned but not recalled and, therefore, not voted by the fund – another DMI data point set to come on stream, giving company boards a fuller picture on the voting power in their stock.

“I think really understanding the patterns of shares on loan and the actual voting impact is another positive step. Boards are often rallying to get something across the finish line and counting shares to understand mathematically what’s needed and often, the votes don’t really match up, it can be really demoralizing,” said Campbell.

As he unveiled the changes in November 2022, SEC Chair Gary Gensler said the move would provide investors with more detailed information about proxy votes.

The reforms, which also aim to create more consistency around how funds describe their proxy votes and ensure Form N-PX is provided in a machine-readable format, are also expected to lead to more productive engagement with boards. “I’m hopeful that this will spark robust conversations for company boards with investors, especially where boards see that they voted ‘against,’ as some of them don’t disclose much in the way of policies,” said Bos. “You have to have these conversations to understand where that vote came from.”

More companies turn to SEC for relief as E&S demands evolve

The number of U.S.-listed companies turning to the Securities and Exchange Commission’s (SEC) no-action process to exclude environmental and social-themed shareholder proposals has surged this proxy season, with the SEC appearing to take a more corporate-friendly approach

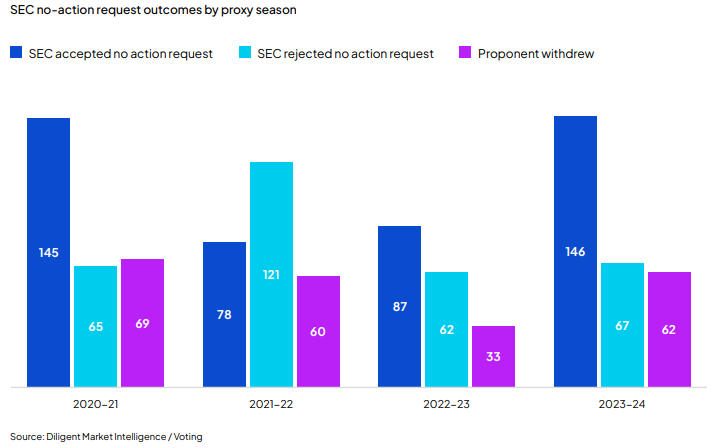

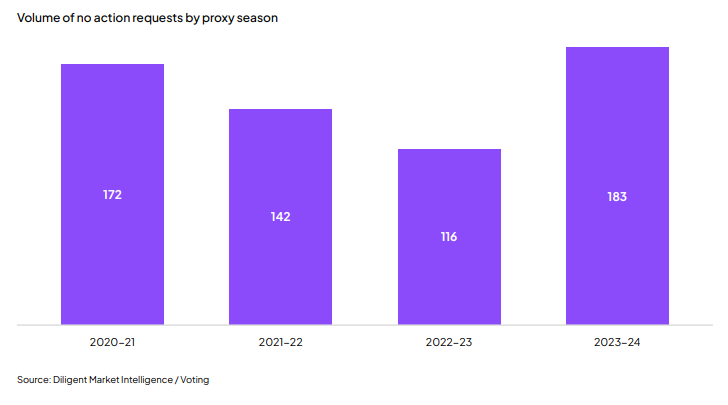

According to Diligent Market Intelligence (DMI) Voting data, a record 183 companies sought no-action relief this proxy season, compared to 116 in 2023, 142 in 2022 and 172 in 2021. The requests, which give companies comfort in excluding shareholder proposals from their proxy statements, have been a political hot topic thanks to a lawsuit filed by ExxonMobil earlier this year, but the latest numbers appear to show the SEC backing more companies.

Of the requests that came before the commission for decision this season, 51% were accepted, compared to 47% last season and 29% in 2022.

“Following [SEC Chair Gary] Gensler’s regime, companies began only putting in letters when they had a very firm basis for exclusion, which led to that contraction we’ve seen over the past two years,” Marc Gerber, partner at Skadden, Arps, Slate, Meagher & Flom, told DMI in an interview. “This year, levels have been returning to normal and with the more novel topics and the more detailed proposals, companies feel they’re more likely to get relief from the SEC, often thanks to a lack of historical precedent on certain new topics.”

Meeting the threshold

In late 2021, a shift in guidance from the SEC meant that companies had to demonstrate that the proposal they sought to exclude did not raise significant social or ethical issues with broad societal impact. The move was seen to create a more difficult threshold for no-action relief with many at the time forecasting the move would lead to more E&S-styled shareholder proposals. However, companies have since returned to lean on the process, often citing procedural defects in an effort to exclude repeat demands or demands seen to micromanage.

No-action relief is commonly sought to exclude climate-themed demands that have evolved from asking target companies to disclose emissions to begin taking steps to reduce such emissions, with many getting “stuck” in the no-action process, as Timothy Smith, senior policy advisor at the Interfaith Center on Corporate Responsibility (ICCR), told DMI.

“We don’t believe that constitutes micromanagement because a) it’s a real crisis and b) the company had often not been clear about what it was going to do to address the risks,” he added. “That’s one of the issues where we feel the SEC may have been too cautious to support the proposal.”

In a landmark case this season, energy giant ExxonMobil bypassed the SEC’s no action process, instead filing a lawsuit against Dutch climate activist Follow This and Arjuna Capital that set out to exclude a demand to accelerate its greenhouse gas (GHG) emissions reduction efforts, after similar proposals from the proponents failed in 2023 and 2022.

While it could not pursue its claim against Netherlands-based Follow This on jurisdictional grounds, a judge ruled in June that the case against Arjuna was no longer valid after the climate activist agreed not to submit a future proposal regarding its GHG emissions.

Exxon CEO Darren Woods has remained steadfast in his criticism of the SEC process, telling the September Council of Institutional Investors conference that the goal of the controversial lawsuit was “simply to get back to a simple interpretation grounded in the intent of the rules,” after the number of no-action requests and approvals fell.

“I lost count of the number of public company CEOs who told me, thanks for doing this. It’s a process that’s being abused and we wish we had the same courage of conviction to do what you’re doing,” he told the gathering.

Crafting next year’s proposals

With engagement well underway for a new season, proponents are reconsidering how best to craft their E&S demands in what many see as a battleground to make it to the ballot paper and amid declining support for those resolutions that do make it to the finish line.

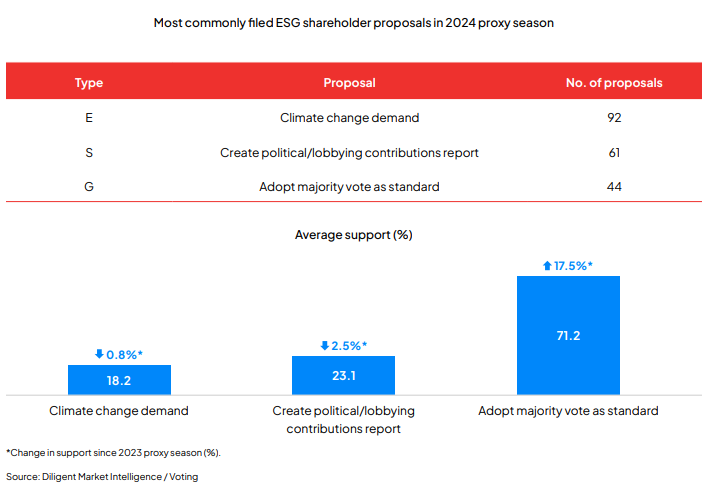

DMI data show that in the 2024 proxy season, environmental-focused proposals targeting companies in the Russell 3000 and S&P 500 indexes secured 19% and 17% average support from investors, respectively while social-themed demands targeting the S&P 500 averaged 14.8% support and 15.4% at Russell 3000.

In deciding on what resolutions do reach shareholders, many argue the SEC no-action process should continue to serve as the right mediator.

“It’s important to remember that the SEC no-action process is still effective because it’s helpful to have a referee and a civil process whereby a company can challenge a resolution for a variety of reasons,” said Smith.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release